Following the announcement from the Agricultural Engineers Association (AEA) that tractor registrations in December were up year on year by 10.4%, at 693 units, details of registrations by horsepower and region have been released.

2023 saw 11,816 tractors registered, an increase of 2% over 2022. In terms of horsepower, the biggest growth was seen in the +161hp range. There was a 23.4% increase in tractors between 161-200hp (2,999 over 2,340 in 2022); a 28.8% rise in machines from 241-320hp from 711 up to 916; and tractors over 320hp rose from 385 units to 467, a 21.3% increase. The total increase above 160hp was 15%.

It should come as no surprise that the average horsepower increased to 173.9hp, more than 5hp above the 2022 figure and beating the previous record set in 2020. The total horsepower of tractors registered exceeded two million for the first time since 2012, a time when nearly 20% more tractors were being sold.

Registrations between 51-100hp also grew by 5.7%, from 1,274 units to 1,346. However, the AEA qualifies this figure by pointing out that some may have been for non-agricultural use. Registrations for the final three months of the year were down by 7% compared to 2022, with only +280hp and 51-70hp machines registering increases.

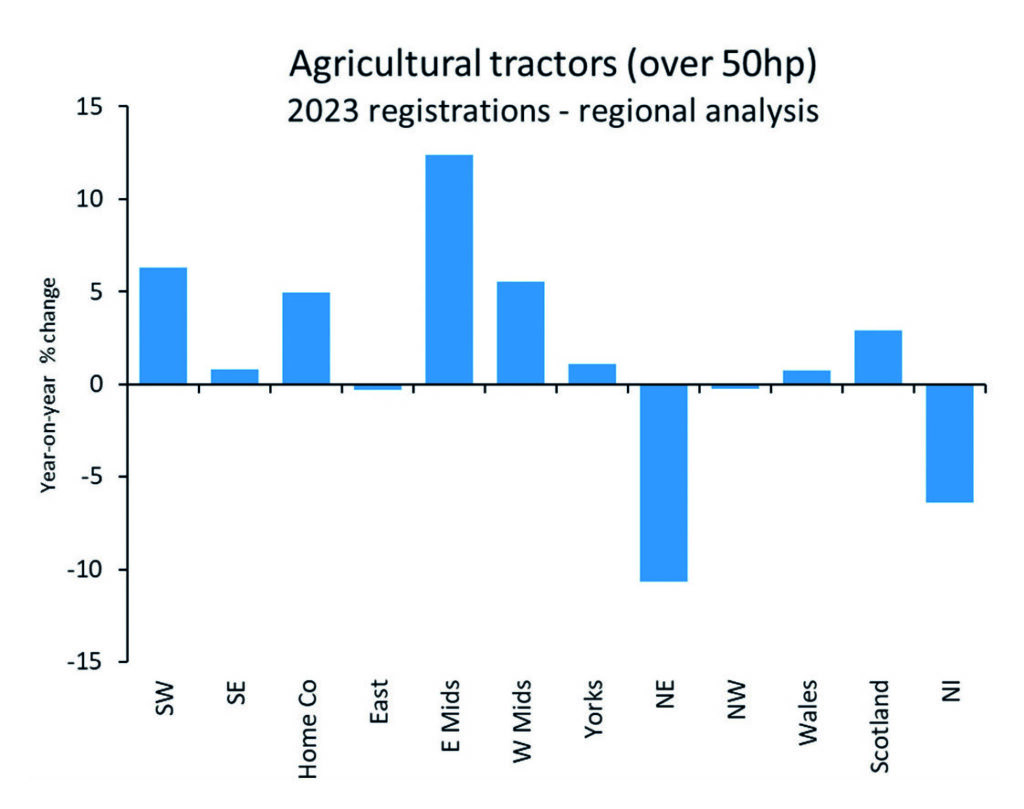

At a regional level, nearly all areas of the UK saw an increase in registrations apart from Northern Ireland which dropped 6.4% from 530 machine in 2022 to 496, and the North East of England which had the largest decrease from 404 to 361, a drop of 10.6%. However, neither area sees high numbers of registrations compared to areas such as Eastern England, or the North West.

The East Midlands saw the most significant percentage increase, jumping from 704 units to 791 (12.4%), followed by the South West which saw 1,777 tractors registered in 2023 – 6.3% higher than 2022 – and the West Midlands, which increased by 5.6% from 666 units to 703.

John Deere returns to the top

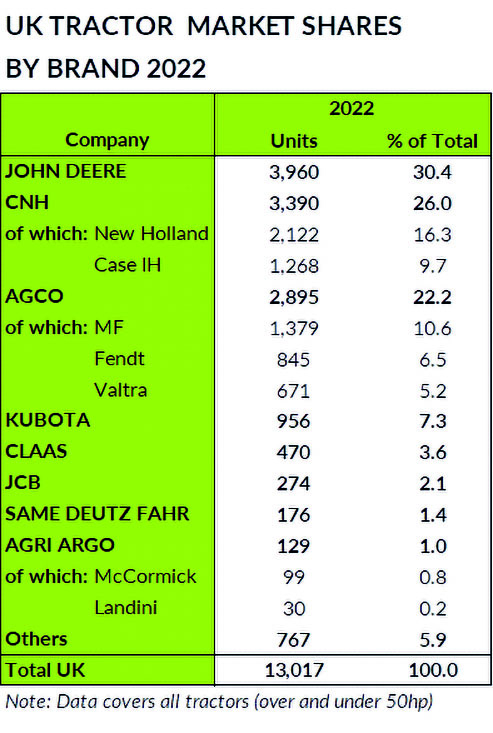

The AEA also published market shares for tractors registered in 2022 – the 12-month delay enforced due to competition law restrictions. After two years beneath CNH (New Holland and Case IH), John Deere was once again at the top of the table with 3,960 units and a 30.4% market share.

CNH was second with 26% (split 16.3% for New Holland and 9.7% for Case IH) and AGCO was third with 22.2% of the market divided between Massey Ferguson (10.6%), Fendt (6.5%) and Valtra (5.2%). The adjoining table shows how the remaining 21.4% of units sold in 2022 was shared among the remaining companies.

The AEA notes that the tractor market in 2021 and 2022 was impacted by global supply chain disruption after the pandemic, as well as the Russian invasion of Ukraine, both of which could have impacted market share.