December registrations bucked the trend last year, according to figures released by the Agricultural Engineers Association (AEA).

Despite an uptick at the end, the final total for 2024 was 13.3% lower than 2023, with 10,241 units registered. This is the lowest since 1998, though the AEA notes it is only fractionally below other low points, such as in 2015, 2016 and 2020.

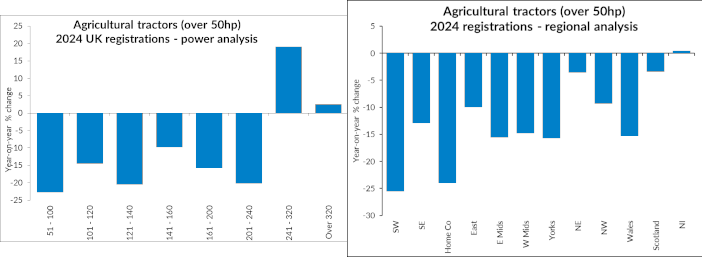

Registrations by power and region

The AEA has also provided a breakdown of the 2024 registrations by region and power. The downward trend was apparent across much of the power range, with only machines above 240hp showing an increase. There were 1,091 tractors between 241-320hp registered, 19.1% higher than in 2023, and 479 machines above 320hp, up 2.6%. Across the rest of the power range, registrations were down 17%.

With growth limited to the most powerful machines, the average horsepower jumped significantly to 179.7hp. This is nearly 6hp higher than in 2023, and more than 10hp higher than in 2022.

Looking at registrations by region, only Northern Ireland saw an increase, though this was a jump of two machines to 498, representing an uptick of just 0.4%. Scotland and the North of England saw smaller decreases than the rest of the UK, with Scotland down 3.4% to 1,358 units, the North East down 3.6% to 348 machines and the North West down 9.4% to 1,173 registrations.

The biggest falls were seen in the South West (-25.5%) and the Home Counties (-24%), although the latter only makes up around 5% of total registrations each year. Because of the drop in the South West, East Anglia now has the highest number of registrations with 1,482 machines – 14.5% of the total.

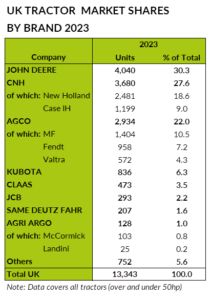

2023 market shares

2023 market shares

Market shares for tractor manufacturers for 2023 have also been released, 12 months after the fact due to competition law restrictions. John Deere retained its position at the top, with 4,040 machines registered (30.3%). While the number of machines increased by 80, the actual market share decreased by 0.1%.

CNH followed with 27.6% of the market, split between New Holland (18.6%) and Case IH (9%); followed by Agco with 22%, made up of Massey Ferguson (10.5%), Fendt (7.2%) and Valtra (4.3%).

These three companies make up 79.9% of the UK market, with the biggest players for the remaining 20.1% being Kubota, Claas and JCB. There was no significant movement among any of the manufacturers year-on-year.