New research conducted by property consultants, Carter Jonas, has revealed that diversification is still essential for farm estates looking to thrive in the future.

The Model Estate report demonstrates that businesses with multiple income streams will have emerged from the turbulent economic climate created by Brexit and the Covid-19 pandemic in the best shape.

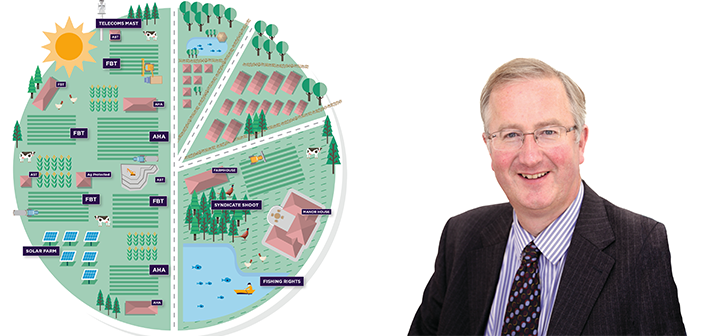

Carter Jonas researchers tracked the performance of various asset classes over the past 12 months. The work included studying the financial returns from let and in-hand farming operations, commercial and residential property, telecoms, fishing rights, shooting and a quarry.

When the figures are applied to the notional 3,168-acre mixed estate, the results clearly show that non-farming income is integral to strong financial performance.

The solar farm’s capital value increased by 8.8% over the past 12 months, while returns from the residential element of the estate returned 4% annual growth.

By contrast, returns from in-hand farming and let land remained flat.

Carter Jonas Head of Rural, Tim Jones, said: “The Model Estate work this year continues to demonstrate that maximising the potential returns from an estate by diversifying and not relying solely on mainstream farming will be essential going forwards.”

Strong performance in the residential sector proved to be important, driven by a desire for space, location and good internet connections.

“As working from home became the norm, buyers realised they didn’t need to be tied to a specific location and house sales in more rural locations increased accordingly,” said Lisa Simon, the firm’s Head of Residential.

“The list of desirable qualities in a property changed to include, principally, more space and a strong internet connection while short commuter links to London took on less importance.

“The same was true for renters, who typically became more open to exploring the freedom and flexibility a new location offered.”

Similarly, a residential component of the in-hand farming operation was the sole reason for 1.4% annual growth. A manor house is included in the researchers’ profile of the farm business.

The impact of a poor harvest was lessened by burgeoning commodity prices, and the value of arable land remained stable, although pasture values fell by 3%.

“The hot, dry weather in the spring significantly reduced harvest yields in 2020,” Mr Jones said. “However, commodity prices witnessed a notable increase as a result of Brexit, and have continued to remain high, partly offsetting the impact.

“The downward tapering of BPS has continued to squeeze farm income across the board, highlighting the importance of diversification, maximising an estate’s potential by finding alternative income streams and reducing costs.”

The Model Estate work is now in its eleventh year, and based on the performance over the past 12 months its total value would increase to £44.36m in December 2020 – growth of 11.6%.

A significant factor was researchers analysing the impact of leasing 25 acres of farmland to introduce a quarry. By the end of 2020 the quarry was worth £4.4m and generated an annual income of £542,500.

“Creating a quarry is clearly not an option open to every estate owner, but this work demonstrates that exploring all the options available to you is essential in order to maximise potential,” Mr Jones added.